|

||||||||||||||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Super Micro Stock Drops on Weak Q3 Preliminary Results. Should You Buy the SMCI Dip?/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

Super Micro Computer (SMCI) stock took a steep hit in after-hours trading on Tuesday, April 29, plunging more than 15% following the release of weak preliminary financial results for its fiscal third quarter of 2025. The server and data center solutions provider shocked investors by sharply cutting its revenue and earnings guidance, triggering concerns about its near-term outlook. Revenue and EPS Guidance CutThe company anticipates Q3 revenue in the range of $4.5 billion to $4.6 billion — down from its prior forecast of $5 billion to $6 billion. The adjusted earnings per share (EPS) outlook was also slashed, with adjusted EPS expected between $0.29 and $0.31, compared to the previously guided range of $0.46 to $0.62. Analysts had been looking for $0.38 in EPS, placing the preliminary estimate well short of the Street’s forecast. The company blamed the earnings shortfall primarily on a weaker gross margin, which fell by 220 basis points compared to the previous quarter. Super Micro cited higher inventory reserves tied to older-generation products and additional costs tied to speeding up new product rollouts. Super Micro pointed to strong design wins for its new generation of products. However, it acknowledged that some customer platform decisions were delayed, pushing certain Q3 sales into Q4.

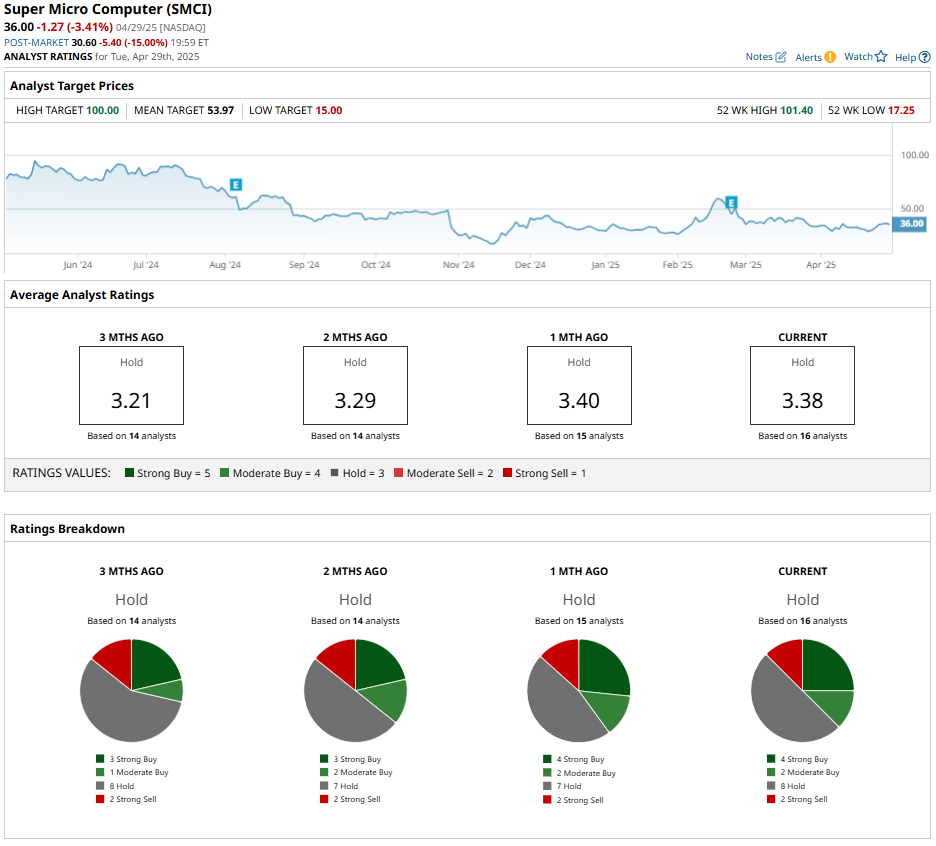

SMCI’s Governance Issues and Recent SetbacksThis latest guidance cut comes amid a challenging period for the company, which has been dealing with reputational damage stemming from financial reporting delays and scrutiny from short sellers. Just a few months ago, Super Micro barely avoided a potential delisting from the Nasdaq Exchange by filing its overdue financial reports for FY24 and the first half of FY25. The company also named BDO its new auditor. Bright Spots: AI Momentum and Technology LeadershipDespite the setbacks, Super Micro’s management was optimistic during the Q2 conference call regarding its long-term prospects, particularly in the AI infrastructure market. Management emphasized its leadership in direct-liquid cooling (DLC) technology, noting that over 30% of new data centers are expected to adopt DLC in the coming year. This positions Super Micro favorably to grow AI infrastructure design wins based on Nvidia’s (NVDA) latest Blackwell platform. Notably, Super Micro delivered impressive growth in Q2. It reported a 54.9% year-over-year increase in net sales, driven by strong demand for its air-cooled and DLC AI GPU platforms. New and existing customers, including major enterprise clients and cloud service providers, are adopting these platforms. AI-related products accounted for over 70% of Super Micro’s revenue, reflecting the company capitalizing on the AI boom. Looking ahead, Super Micro projects FY25 revenue between $23.5 billion and $25 billion and expects to hit $40 billion in sales by FY26. Risks Remain: Customer Concentration and Tariff UncertaintyWhile SMCI’s long-term growth story is compelling, there are risks investors should keep an eye on, particularly with the company’s growing reliance on a small number of large customers. The company’s most recent quarterly filing revealed that just two customers were responsible for 27.1% and 30.6% of net sales in Q2 alone. In the first half of FY25, three customers made up 59.8% of sales. Such concentration introduces vulnerability. If even one of these customers scales back orders or shifts to a competitor, it could substantially impact Super Micro’s financial results. In short, Super Micro is well-positioned to benefit from the surging demand for AI infrastructure, thanks to its high-performance server solutions. Despite its impressive growth story and bullish long-term outlook, investors should weigh the risks, especially customer concentration and tariff uncertainty. The Bottom LineThe ongoing volatility in SMCI is hard to ignore, with the company significantly eroding its shareholders’ value. Super Micro stock has shed 70.2% from its 52-week high of $101.40, raising concerns about whether the long-term AI opportunity can offset the governance and execution concerns. The significant drop in Super Micro stock could be a buying opportunity for investors with a high risk tolerance and long-term outlook. But for now, the road ahead looks rocky, and the company must prove that its bold projections are more than talk. Wall Street analysts remain cautious and maintain a consensus rating of “Hold.”

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|